Measure What Matters: KPI Dashboards and Financial Analytics for Solopreneurs

Define Success with Precision

Build a Lean, Reliable Dashboard

Spreadsheet-First, Results-Driven

No-Code Automation That Sticks

Visual Design for Instant Insight

Cash Flow Without Surprises

Pricing and Unit Economics That Compound

Review Rhythms That Drive Action

From Chaos to Clarity: A Solo Founder’s Story

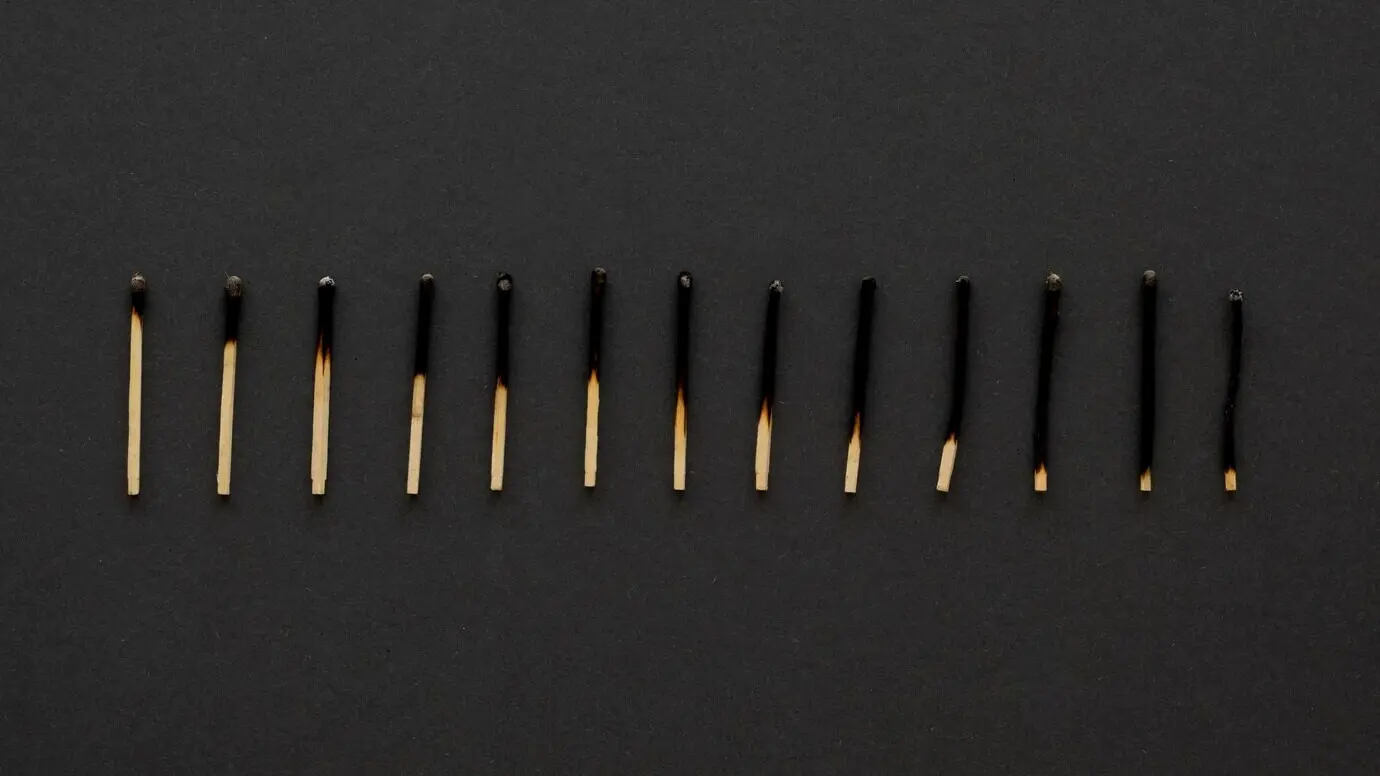

Where Things Started to Fray

Revenue was decent, but refunds and delays erased predictability. Scope kept expanding, proposals lacked tiered options, and the pipeline view lived mostly in memory. Without a 13-week forecast, surprise expenses caused needless stress. Listing recurring costs, mapping delivery stages, and logging time revealed why days felt frantic. The turning point arrived when she measured the gap between promise and process, then asked which single constraint, if fixed, would create breathing room.

What Changed, Practically and Mindset-Wise

She introduced milestone billing, added a productized audit offering, and converted scattered notes into a weekly scorecard. A minimalist dashboard tracked pipeline value, gross margin per package, and outstanding invoices. Automation handled reminders while captions explained trends in plain language. The mindset shift was simple: numbers were not judgment; they were navigation. That belief made iteration joyful, because each small improvement showed up quickly, reinforcing focus and the satisfaction of consistent, reliable delivery.

Outcomes, Learnings, and Your Next Move

Win rates improved with clear tiers, average project value increased, and turnaround time shortened. Most importantly, her calendar matched her energy. The lesson is practical: choose a few indicators, review them on schedule, and let thresholds trigger actions. Build buffers so experiments feel safe. If you’re ready, reply with one financial question or KPI you want clarity on, and we’ll shape upcoming guidance around your real constraints and goals.